Vietnam Cosmetics: Vietnam’s Emerging Cosmetics Industry – Huge Market Growth Potential. Vietnam’s cosmetics market is still young, but it is one of the most dynamic in the region. With the improvement of living standards in Vietnam, Vietnamese consumers pay more attention to personal care and beauty products in addition to meeting basic needs. With a market capitalization of up to US$2.3 billion in 2021, Vietnam Briefing analyzes the status quo, opportunities and challenges for companies entering the industry.

Vietnam Cosmetics: Cosmetics are big business in Vietnam

Cosmetics are big business in Vietnam. The industry is booming due to rising living standards and large numbers of Vietnamese consumers investing in personal care and beauty products.

Vietnam has jumped from a low-income country to a middle-income country, and more and more middle-income earners spend more of their income on cosmetics. Middle-class women in Vietnam spend an average of VND450,000-500,000 (US$19-21) per month on cosmetics and skin care products.

Rising disposable income, evolving beauty standards, popularity of social media, and Hallyu are all driving the growth in demand for beauty products in Vietnam.

South Korea is known for its skincare and makeup routines. Korean idols and influencers are driving the self-care trend in Vietnam through social media, events, advertisements and beauty blogs. Furthermore, the greater financial independence of working women in Vietnam has increased their demand for beauty treatments, while evolving beauty standards have led men to pay more attention to personal hygiene.

Since 2018, the percentage of women in Vietnam who use cosmetics has increased from 76% to 86%. Vietnam’s cosmetics market is expected to grow at an annual rate of 15% to 20% over the next decade.

In 2019, Vietnam’s skin care products market totaled US$850 million, and is expected to reach US$1.9 billion by 2027, with a CAGR of 11.7% during 2021-2027.

Vietnam Cosmetics: Cosmetics Market Overview

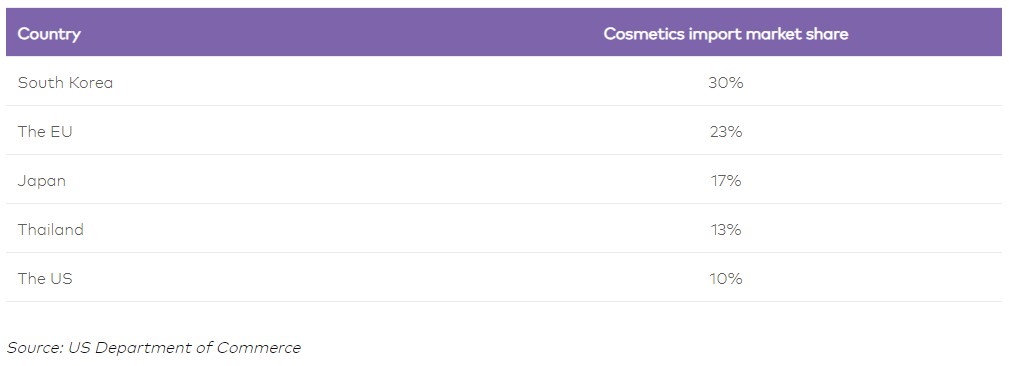

Vietnam is a hotspot for foreign cosmetics brands, with up to 93% of personal care products imported. South Korea is Vietnam’s main cosmetics exporter, followed by Europe, Japan, Thailand and the United States.

Cosmetics Market Overview

Other exporters of beauty and personal care products are Singapore and China. Domestic brands now account for less than 10 percent of total consumption. Domestic brands mainly focus on affordable low-end products that compete on price.

Beauty and personal care products are a range of products used for enhancing or maintaining one’s physical appearance or personal hygiene. These products are used by both men and women and include a wide range of items such as skincare products, haircare products, makeup, perfumes, deodorants, and oral hygiene products.

Skincare products are used for cleansing, moisturizing, and protecting the skin. These include facial cleansers, toners, moisturizers, serums, and sunscreens. Haircare products are used for cleansing, conditioning, and styling the hair. These include shampoos, conditioners, hair masks, and styling products such as gels, hairsprays, and pomades.

Makeup is used for enhancing one’s facial features and includes products such as foundations, concealers, blushes, eyeshadows, mascaras, and lipsticks. Perfumes are used for personal fragrance and include a range of scents from floral to musky. Deodorants are used for controlling body odor and are available in forms such as sprays, sticks, and roll-ons. Oral hygiene products include toothpaste, mouthwash, and dental floss.

Beauty and personal care products are often formulated with a variety of ingredients such as vitamins, minerals, plant extracts, and essential oils. These ingredients are chosen for their beneficial properties such as moisturizing, anti-aging, or brightening effects.

Consumers have a wide range of options when it comes to beauty and personal care products, with different products and brands targeting specific needs and preferences. These products can be found in various forms such as liquids, creams, gels, powders, and sprays, and can be purchased from brick-and-mortar stores or online retailers.

Vietnam Cosmetics: Cosmetics Market Overview

The dominance of foreign players in the market is mainly due to Vietnamese preference for imported products. Vietnamese consumers perceive foreign brands to have higher quality products and a wider range of products that can meet individual needs.

In 2019, the import value of Vietnam’s beauty products was about 950 million US dollars. Key imported products include facial cleansers, facial moisturizers, lipsticks for women and grooming/shaving products for men.

The opening of various retail chains such as Watsons, Guardian, and new players such as Pharmacity and Matsumoto have expanded the reach of imported cosmetics to Vietnam’s middle-class and affluent consumers.

At the same time, large and high-quality foreign cosmetics companies, realizing the potential of Vietnam’s young but emerging market, have opened representative offices or sold through agents and distributors, such as:

- Unilever: Market share as high as 12%, well-known brand: Pond’s

- Beiersdorf Vietnam: Nivea

- LG Vina Cosmetics: Ohui (high-end), The Face Shop

- Amorepacific Vietnam: Laneige, Innisfree

- L’Oreal Vietnam Co., Ltd.: L’Oreal

Some domestic brands such as Thorakao, Saigon Cosmetic, Lana, Sao Thai Duong and new player Cocoon have gained some popularity.

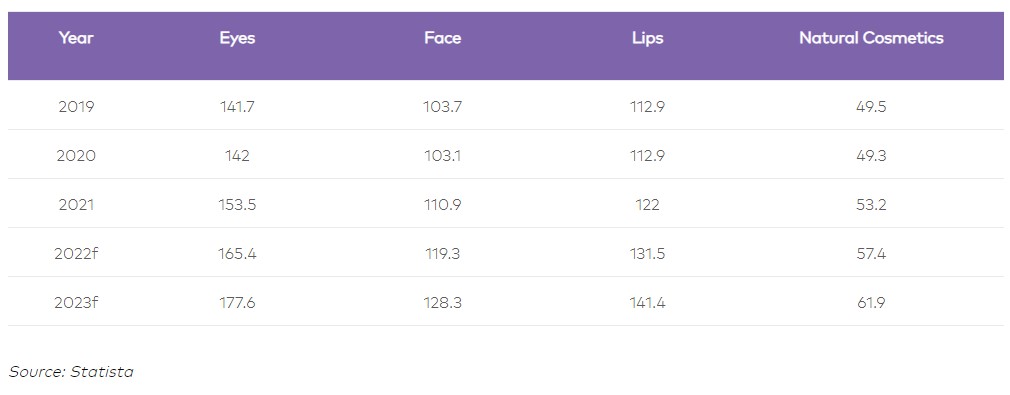

From 2019 to 2023, the cosmetics market revenue in Vietnam has been growing steadily across all industries.

Revenue over the years in US$ (millions):

Revenue over the years in US$ (millions):

Eye and lip products are the two dominant segments of the market, valued at over USD 100 million annually as of 2018. The natural cosmetics industry is weaker but has huge growth potential in the medium term. In fact, more and more people are turning their attention to clean, organic and herbal ingredients, which are considered healthy and environmentally friendly compared to chemical cosmetics.

To provide investors with a comprehensive overview of the Vietnam cosmetics and personal care market, we provide the following PEST (Political, Economic, Social and Technical) analysis:

Vietnam Cosmetics: Opportunities and challenges for old and new players

Vietnamese people are becoming more and more health-conscious and pay close attention to the ingredients of beauty products in the market. This opens up new opportunities for cosmetics companies looking to expand their existing scale or new entrants looking to enter Vietnam’s cosmetics (Vietnam Cosmetics) and personal care market.

Investors should be wary of domestic production and distribution of organic beauty products for two main reasons.

Vietnam Cosmetics: Opportunities and challenges for old and new players

First, Vietnam has relatively cheap organic and herbal ingredients that can be used in beauty products. Coconut, an ingredient abundant in the Mekong Delta region of Vietnam, is an important part of many beauty products.

Vietnam is a country with a long tradition of using herbal remedies for various ailments and health benefits. Here are some of the best herbal ingredients that Vietnam has to offer:

- Vietnamese cinnamon: Also known as Saigon cinnamon, this spice is commonly used in Vietnamese cuisine and is believed to have a number of health benefits. It is rich in antioxidants, which can help protect the body against damage from free radicals, and has been shown to have anti-inflammatory and antimicrobial properties.

- Turmeric: Turmeric is a bright yellow spice that is commonly used in Vietnamese cuisine and is known for its anti-inflammatory properties. It contains a compound called curcumin, which has been shown to have antioxidant and anti-inflammatory effects. Turmeric is often used in traditional Vietnamese medicine to treat a variety of conditions, including arthritis, digestive issues, and skin conditions.

- Lemongrass: Lemongrass is a fragrant herb that is commonly used in Vietnamese cuisine, and is believed to have a number of health benefits. It has antimicrobial properties and may help to reduce inflammation and pain. Lemongrass is also believed to have calming and stress-reducing properties, and is often used in aromatherapy.

- Ginger: Ginger is a common ingredient in Vietnamese cuisine, and is known for its anti-inflammatory properties. It contains compounds called gingerols and shogaols, which have been shown to have antioxidant and anti-inflammatory effects. Ginger is often used to treat digestive issues, such as nausea and vomiting, and may also help to reduce inflammation and pain.

- Star anise: Star anise is a fragrant spice that is commonly used in Vietnamese cuisine, and is believed to have a number of health benefits. It contains compounds called polyphenols, which have been shown to have antioxidant and anti-inflammatory effects. Star anise is often used in traditional Vietnamese medicine to treat respiratory and digestive issues, and may also have antibacterial and antifungal properties.

- Ginseng: Ginseng is a popular herbal supplement that is widely used in traditional Vietnamese medicine. It is believed to have a number of health benefits, including improved cognitive function, increased energy, and reduced inflammation. Ginseng contains compounds called ginsenosides, which have been shown to have antioxidant and anti-inflammatory effects.

Lemongrass

In summary, Vietnam is home to a number of herbal ingredients that are used for their health benefits, including Vietnamese cinnamon, turmeric, lemongrass, ginger, star anise, and ginseng. These herbs and spices are commonly used in Vietnamese cuisine and traditional medicine, and may offer a range of benefits for overall health and wellbeing.

Next is turmeric, green tea and aloe vera, three ingredients native to Vietnam that work to repair damaged skin. In general, Vietnam is home to a variety of organic ingredients – a great base for companies looking to develop organic products domestically.

Second, the mindset of local consumers is changing, with a particular focus on the quality of personal care products, especially among Gen Zers. Hence, organic and herbal products are likely to see huge growth in the beauty market. Big companies are already making changes. Market leader L’Oréal has launched its popular Inoa hair dye, which it says is free from oil and ammonia, while Beiersdorf’s Nivea has launched a natural skin care range.

But challenges remain. A major hurdle is that Vietnam’s cosmetics market is quite young and unstable. A big driver behind the high demand for cosmetics is the Hallyu wave. However, South Korea’s trend reverses from time to time, making Vietnam’s cosmetics market prone to instability. In addition, the cosmetics market is also significantly influenced by recommendations from Korean celebrities. The recognition that one product is superior to another has an impact and impacts product sales, leading to challenges for companies.

Another challenge of the market is that it is very price sensitive. Since a large proportion of consumers are young people with lower incomes, they are more inclined to choose low-priced products rather than high-end products. In order to be competitive, it is important that cosmetic and personal care companies’ price ranges are as close as possible to the purchasing power of Vietnamese consumers.

The Vietnamese cosmetics market also poses a challenge to Western brands due to consumer stereotypes

The Vietnamese cosmetics (Vietnam Cosmetics) market also poses a challenge to Western brands due to consumer stereotypes. Due to physical differences, consumers perceive products made in Asia to suit their skin types better than products made in Europe.

However, as long as Western brands show a strong commitment to quality, this problem can be alleviated, as Vietnamese consumers place greater value on premium ingredients.

Why is it worth investing in the Vietnam market?

Vietnam Cosmetics: For a young market like Vietnam that imposes high tariffs on imported cosmetics and personal care products, the question most often asked is: What makes Vietnam a valuable business?

Why is it worth investing in the Vietnam market?

It is worth noting that Vietnam imposes tariffs of 10-27% on cosmetics and personal care products, while VAT is 10%. Import duties on beauty products are calculated based on the CIF (Cost, Insurance, Freight) value of each shipment. This tariff line is quite high compared to other countries in the region.

CIF (Cost, Insurance, Freight) value is a term used in international trade to describe the total cost of importing goods from one country to another.

CIF (Cost, Insurance, Freight) value is a term used in international trade to describe the total cost of importing goods from one country to another. It is a type of incoterm, which is a set of standardized rules that define the responsibilities and liabilities of buyers and sellers in international transactions.

The CIF value includes three main components: the cost of the goods (i.e., the price paid to the supplier), the cost of insurance to protect the goods during shipment, and the cost of freight (i.e., shipping and handling charges). The seller is responsible for arranging and paying for the insurance and freight, while the buyer is responsible for arranging and paying for any additional fees, such as customs duties and taxes.

The CIF value is typically used in international trade contracts to determine the final price of the goods, as it takes into account all of the costs associated with transporting the goods from the supplier’s location to the buyer’s location. It is important to note that the CIF value only covers the costs associated with transporting the goods up to the port of destination, and does not include any additional costs associated with transporting the goods from the port to the final destination.

One potential advantage of using CIF value in international trade is that it provides a clear and standardized method for calculating the total cost of importing goods. However, there are also some potential drawbacks to using CIF value, such as the fact that it does not take into account any discounts or promotions that may be offered by the supplier, and that it can be difficult to compare prices between different suppliers using CIF value alone.

In summary, CIF value is a term used in international trade to describe the total cost of importing goods, including the cost of the goods, insurance, and freight. It is a standardized method for calculating the total cost of importing goods, but does not take into account any additional costs associated with transporting the goods from the port to the final destination.

High import duties drive up the prices of most imported beauty products. Consumers in Vietnam pay at least US$3.42 (80,000 VND) for a typical shampoo product, while the same shampoo costs around US$2 (46,000 VND) in Germany.

Given these differences in price ranges, Vietnamese spend even more than consumers in developed countries on cosmetics and personal care products. That means Vietnamese consumers are willing to pay for high-quality products, and beauty products are in high demand – an opportunity for investors to tap into this young but import-hungry market.

Basic requirements for exporting cosmetics to Vietnam

The registration of imported cosmetics in Vietnam (Vietnam Cosmetics) is regulated by the Drug Administration of Vietnam (DAV) under the Ministry of Health (MOH). Every exporter and importer must obtain the proper certificates from these government agencies. All imported cosmetic and personal care products must be registered with the Ministry of Health, and the following information needs to be provided on the packaging:

- Name, product features;

- Ingredient list formula;

- Instructions for use;

- Country of origin;

- Distributor’s name and address (written in Vietnamese);

- Weight, volume;

- Date of manufacture and expiration date; and

- Manufacturing lot number.

The Drug Administration of Vietnam (DAV) is a regulatory agency responsible for the management and oversight of drugs and cosmetics in Vietnam. The DAV is part of the Ministry of Health and is responsible for ensuring the safety, quality, and efficacy of drugs and cosmetics in the country.

The DAV’s primary role is to develop and implement regulations and guidelines related to drug registration, manufacturing, distribution, and sales. The agency also oversees the inspection and supervision of drug manufacturing facilities to ensure compliance with Good Manufacturing Practices (GMP) and other quality standards.

The DAV is responsible for the registration of all drugs and cosmetics in Vietnam, including imported products. Companies seeking to market their products in Vietnam must submit an application to the DAV, which includes information about the product’s safety, quality, and efficacy.

The DAV is also responsible for monitoring adverse drug reactions and enforcing penalties for non-compliance with regulations. The agency works closely with other government agencies and international organizations to stay up-to-date on the latest developments in drug regulation and to ensure that Vietnam’s regulatory framework is in line with international standards.

Overall, the DAV plays a critical role in ensuring that the drugs and cosmetics available in Vietnam are safe and effective for consumers. Its work helps to protect public health and ensures that the country’s regulatory framework is in line with international standards.

Cosmetic Reporting Program

Cosmetic Reporting Program

Companies importing and distributing cosmetic and personal care products in Vietnam should prepare the following documents:

- Two copies of the registration form with the registration data;

- Legal original or notarized copy of the authorization letter from the product manufacturer or owner authorizing the registrant to distribute the product in the Vietnamese market; and

- Legal original or notarized copy of valid Certificate of Free Sale (CFS). However, CFS is exempt for products produced in countries that are members of the Comprehensive and Progressive

- Agreement for Trans-Pacific Partnership (CPTPP) or ASEAN.

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) is a free trade agreement signed by 11 countries bordering the Pacific Ocean: Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam. The CPTPP aims to eliminate tariffs on goods traded between member countries, reduce non-tariff barriers to trade, and establish common standards on labor and environmental protections, intellectual property, and other issues related to trade. The agreement was signed in March 2018 and came into effect in December 2018.

The Association of Southeast Asian Nations (ASEAN) is a regional intergovernmental organization consisting of ten countries in Southeast Asia: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. ASEAN aims to promote economic, political, and security cooperation among its member states. One of ASEAN’s key initiatives is the ASEAN Free Trade Area (AFTA), which aims to create a single market and production base for goods and services in the region, eliminating tariffs on most goods traded between member states. ASEAN also has several other agreements in place, such as the ASEAN-China Free Trade Area and the ASEAN-Australia-New Zealand Free Trade Area, aimed at promoting trade and economic cooperation with other countries and regions.

While both the CPTPP and ASEAN are regional trade agreements that aim to promote economic cooperation and free trade among member states, there are some key differences between the two. The CPTPP includes countries from outside of the Southeast Asian region, such as Canada, Chile, and Japan, while ASEAN is comprised entirely of Southeast Asian countries. Additionally, the CPTPP has a greater focus on common standards and regulations related to trade, including labor and environmental protections and intellectual property rights, while ASEAN’s main goal is to create a single market and production base for goods and services in the region.

Overall, both the CPTPP and ASEAN are important trade agreements that have helped to promote economic cooperation and free trade among member countries. The CPTPP has the potential to increase trade between Pacific Rim countries, while ASEAN has been instrumental in promoting economic development and cooperation among Southeast Asian countries.

The required documents are then submitted online to DAV through the Vietnam National Single Window. The registration fee is VND 500,000 (US$ 21.38). The process takes up to 7-10 working days before DAV issues the result: a receipt number, which also acts as a product license number, valid for 5 years from the date of issue.

Vietnam Cosmetics: Takeaways

The cosmetics market in Vietnam is still in its infancy, which has both advantages and disadvantages for domestic and foreign companies. As skincare and cosmetics have become a daily routine for many Vietnamese consumers, the market is only expected to grow in the long term. Vietnam is an emerging market for cosmetics and personal care companies due to ample supply and growing demand for organic ingredients.

Leave a reply